40 coupon vs interest rate

CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in... Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Difference Between Coupon Rate and Interest Rate (With Table) Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Coupon vs interest rate

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... Let us discuss some of the major differences between Coupon Rate vs Interest Rate : 1. The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requi... Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

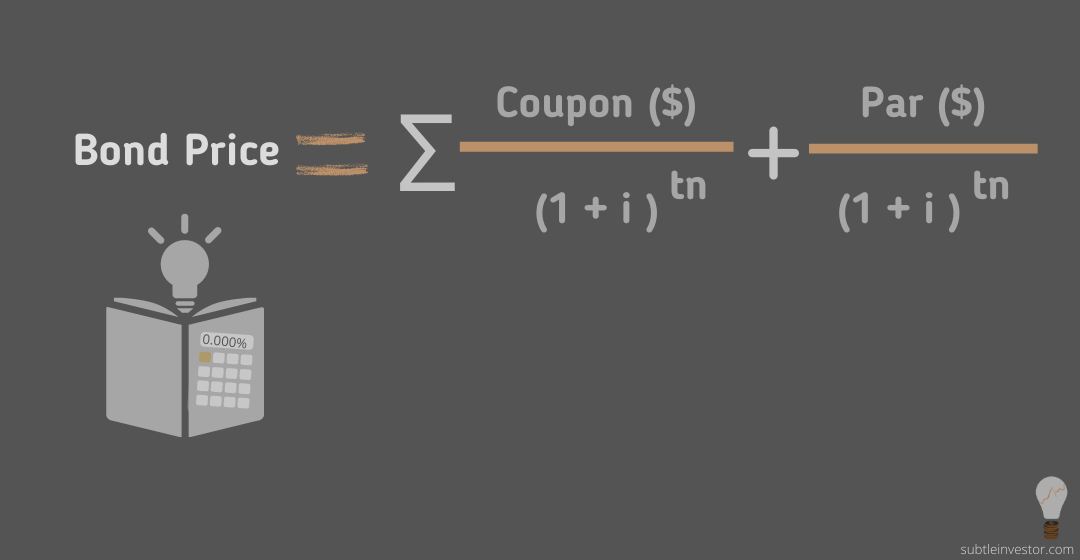

Coupon vs interest rate. Coupon Rate Definition - Investopedia Market interest rates change over time and as they move lower or higher than a bond's coupon rate, the value of the bond increases or decreases, respectively. Since a bond's coupon rate is fixed... Coupon Rate Calculator | Bond Coupon For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Discount Rate vs Interest Rate | 7 Best Difference (with ... - EDUCBA An interest rate is an amount charged by a lender to a borrower for the use of assets. Discount Rate is the interest rate that the Federal Reserve Banks charges to the depository institutions and to commercial banks on its overnight loans. Charged on. Individuals/ Borrowers. Depository institutions/ Commercial banks. Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

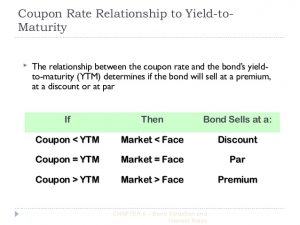

Coupon Rate vs Interest Rate | Top 8 Best Differences (with ... The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser. What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates. Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between Coupon Rate and Interest Rate Dec 03, 2014 · What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Discount Rate vs Interest Rate | Top 7 Differences (with Infographics) Discount Rate vs. Interest Rate Key Differences. The followings are the key differences between Discount Rate vs. Interest Rate: The use of discount rate is complex compared to the interest rate as the discount rate is used in discounted cash flow analysis for calculating the present value of future cash flows over a period of time, whereas the interest rate is generally charged by the ... What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. APY vs Interest Rate: What Is the Difference [Guide for 2022] APY: the actual rate of return you'll earn with compounded interest. Interest rate: the fixed rate of return you receive on savings accounts. APY vs interest rate: both earn you money on interest-based accounts. Interest rates are more common and offer lower returns than an APY. The higher the APY, the better.

Difference Between Coupon Rate and Required Return (With Table) Difference Between Coupon Rate and Required Return (With Table) The rate of interest paid by the person who issues the bond based on the bond's face value is called the coupon rate. The periodic interest paid by the person who issues the bond to the buyer is called the coupon rate.

Bond yield vs coupon rate: Why is RBI trying to keep yield down? An increase in YTM indicates below normal coupon rate or that the interest rates are forcibly kept low, resulting in fall in market value of the bonds. Wednesday, May 18, 2022.

Coupon Vs Interest Rate Coupon Vs Interest Rate . Coupon Vs Interest Rate, Clipdeals Com Calgary, Full Mattress Set Deals, Bagittoday Coupons June 2020, Burger King Coupons Canada Pdf, Lakeshore Coupons For Free Shipping, Evans Halshaw Ford Finance Deals ...

COUPON RATE VS INTEREST RATE - 30% Off Coupons & Promotional Codes 2022 Take 10% Off Coupon Rate Vs Interest Rate - Hurry Up! Activate this discount code at the checkout page to get 15% off on your order at the store. Buy now! SHOW DEAL Verified and Tested 10% OFF Deal Utilize This Coupon Rate Vs Interest Rate To Grab 10% OFF We present you with the latest coupon code to save 10% off on all sitewide purchases.

APR Vs. Interest Rate: What's The Difference? - Forbes Advisor Interest Rate vs. APR. Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR. Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR.

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

I Bonds And TIPS Compared: Which Are A Better Buy? You could cash in the I bond, pay tax on the interest, and use the proceeds to buy long-term TIPS paying better than the current 0.7%. But now look at the main disadvantage to I bonds. They are ...

Coupon Rate Vs Interest Rate - 30% Off Discount & Voucher Codes 2022 Coupon Rate Vs Interest Rate . 10% OFF. Deal. Additional 10% Off On Your Final Cart Value. Get the best discount on almost everything using the latest 20% off Promo Code at checkout page. Time Is Running Out. 0 comments ; Report; SHOW DEAL. 10% OFF. SHOW DEAL. 20% OFF. Deal. You're Inivted! Almost 20% Off Your Order

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... Let us discuss some of the major differences between Coupon Rate vs Interest Rate : 1. The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requi...

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent.

/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

Post a Comment for "40 coupon vs interest rate"