40 coupon rate and yield to maturity

Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep At maturity, the face value (i.e. the par value) of the bond is returned in full to the bondholder, marking the end of the coupon payments. Bond Coupon Rate Formula The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond › Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Coupon rate and yield to maturity

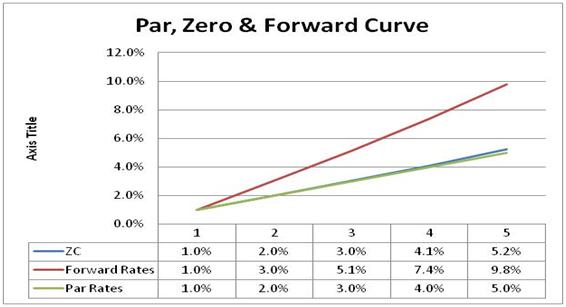

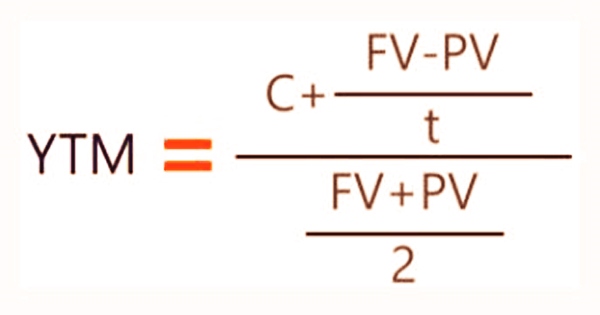

Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5. Yield to Maturity Questions and Answers | Homework.Study.com What is the annual yield to maturity of a corporate bond with 15 years to maturity, a coupon rate of 9% per year, a $1,000 par value, and a current market price of $1,260? ... a private investor, purchases $1,000 par value bonds with a 12 percent coupon rate and a 9 percent yield to maturity. Devin will hold the bonds until maturity. Thus, he ... Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments.

Coupon rate and yield to maturity. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity PDF Yield-to-Maturity and the Reinvestment of Coupon Payments that in order to earn the yield to maturity on a coupon bond an investor must reinvest the coupon payments. We identify a ... She goes on to specify that the "coupons are reinvested at an interest rate equal to the yield-to-maturity." (Thau 2002, p. 25).

Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity? Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield compares the coupon...

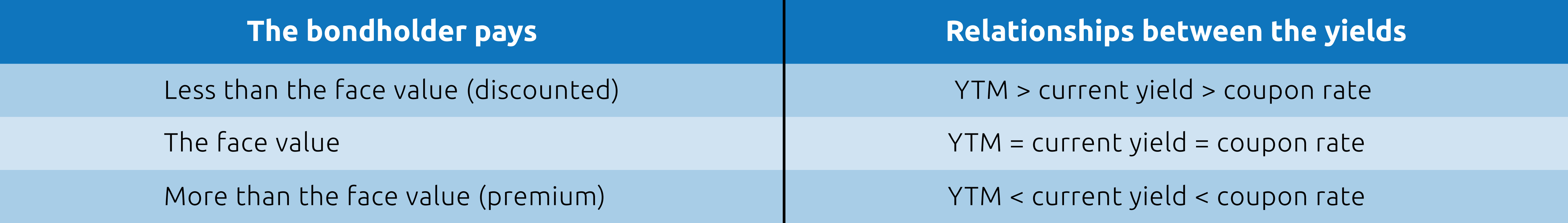

How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ...

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Coupon Rate Yield; Definition: The coupon is similar to the interest rate, which is paid by the issuer of a bond to the bondholder as a return on his investment. The yield to maturity of a bond is the interest rate for a bond, which is calculated on the basis of coupon payment and the current market price of a bond. Basis of calculation

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Post a Comment for "40 coupon rate and yield to maturity"