44 risk of zero coupon bonds

The One-Minute Guide to Zero Coupon Bonds | FINRA.org That said, zero-coupon bonds carry various types of risk. Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. The Basics Of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

Risk of zero coupon bonds

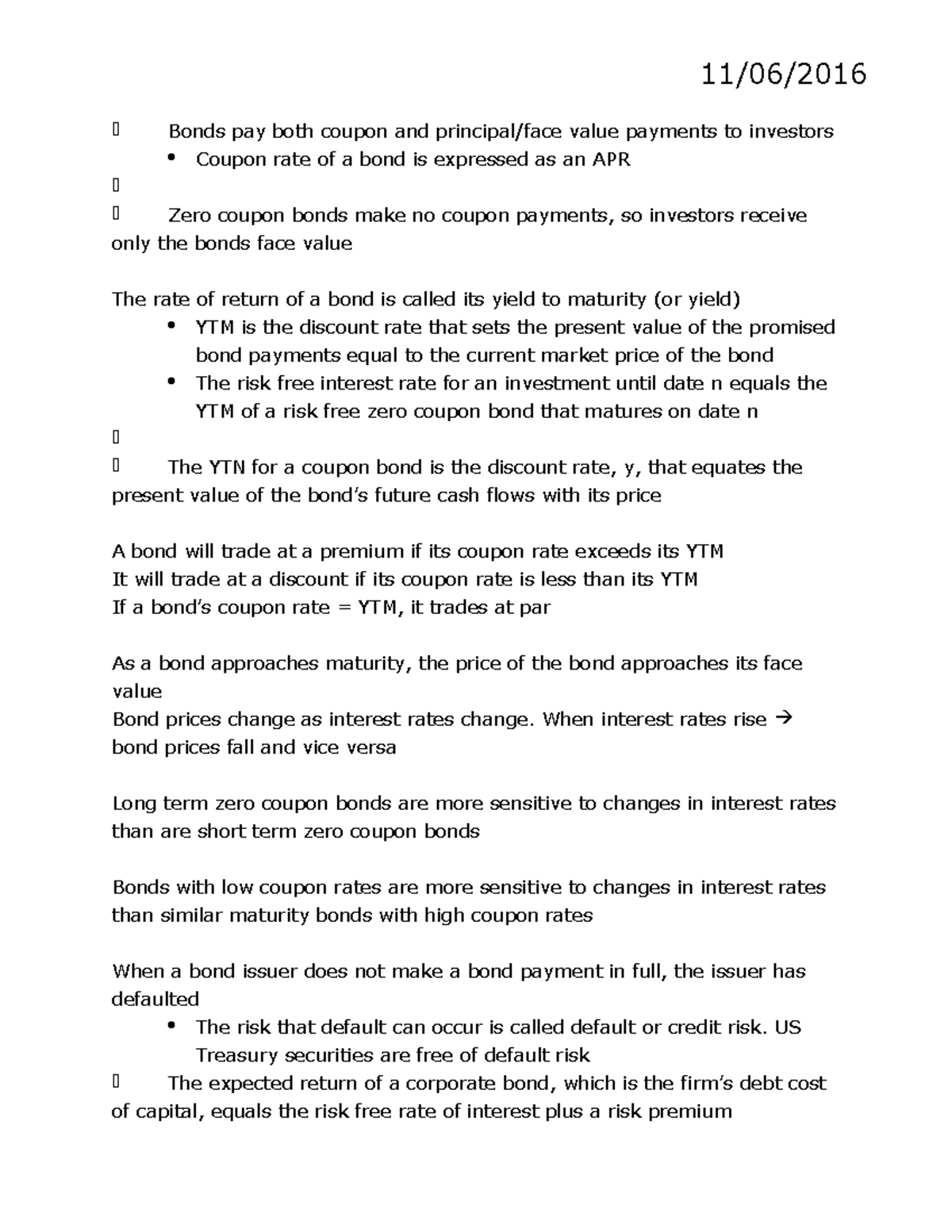

Ordinary citizens face higher risk in buying corporate bonds A major vulnerability, according to the report, was their lack of capacity to conduct in-depth analysis and risk assessment in buying corporate bonds and stocks. The ministry advised potential investors to carefully study bond issuers’ business performance, and the demand for their products and services before putting money down. Understanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

Risk of zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than … Invest in G-SEC STRIPS India - Bondsindia.com Stripping is the process of separating a standard coupon-bearing bond into its individual coupon and principal components. For example, a 10 year coupon bearing bond can be stripped into 20 coupon and one principal instruments, all of which thenceforth would become zero … Vanguard - Fixed income - Corporate bonds Zero coupon bonds pay no periodic interest. The bonds are purchased at a discount and redeemed for the full face value at maturity. Generally, investors must pay income tax on interest accrued annually on zero coupon bonds even though no cash interest payments are received. ... All corporate bonds carry the credit risk that the issuer will ... Zero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · “Zero coupon bonds are highly beneficial when the interest rates are high and there is no re-investment risk during the life period of the bond for the investors,” said Srinivasan of Rockfort ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Understanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Ordinary citizens face higher risk in buying corporate bonds A major vulnerability, according to the report, was their lack of capacity to conduct in-depth analysis and risk assessment in buying corporate bonds and stocks. The ministry advised potential investors to carefully study bond issuers’ business performance, and the demand for their products and services before putting money down.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "44 risk of zero coupon bonds"