44 zero coupon bonds definition

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond ...

zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ...

Zero coupon bonds definition

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a bond that doesn't result in recurring interest income for the bondholder. The owner buys the bond at a discount, and the difference between the bond's purchase price and face value is the profit. ... Definition: A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

Zero coupon bonds definition. Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ... zero coupon bond - Definition, Understanding, and ... - ClearTax Aug 25, 2022 — What is Zero Coupon Bond ... This is an accrual bond that does not pay the interest but trades at a major discount, giving a profit at maturity ... Fixed Income - Definition, Securities, Instruments, Examples On the other hand, Zero-Coupon Bonds Zero-Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face value of the bond, which is … What are Bonds? definition, features and types - Business Jargons Definition: Bonds can be defined as the negotiable instrument, issued in relation to borrowing arrangement, that indicates indebtedness.It is an unsecured debt instrument, in which the bond investor extends credit to the issuer, which in turn commits to repay the loan amount on the specified maturity date, along with interest throughout the life of the bond.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... What is a Zero-Coupon Bond? Definition and Meaning A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. Accounting for Bonds | Premium | Discount | Example Accounting for Bonds Definition. Bonds Payable is the promissory note which the company uses to raise funds from the investor. Company sells bonds to the investors and promise to pay the annual interest plus principal on the maturity date. It is the long term debt which issues by the company, government, and other entities. It must be ... Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

How to Buy Zero Coupon Bonds | Finance - Zacks CDs. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Zero-coupon bonds ... - OECD Glossary of Statistical Terms Aug 29, 2003 — A single-payment security that does not involve interest payments during the life of the bond.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Convertible Bonds: Definition and Example Calculation Where: C is coupon value, r is rate, n is year and CV is conversion value. Example: ABC Co has issued 100,000 units of convertible bonds with a nominal value of US$100 each. The coupon rate of the bonds is 10% payable annually. Each of the US$100 convertible bonds can be converted into 50 ordinary shares in three years’ time. If any bonds are ...

Bond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

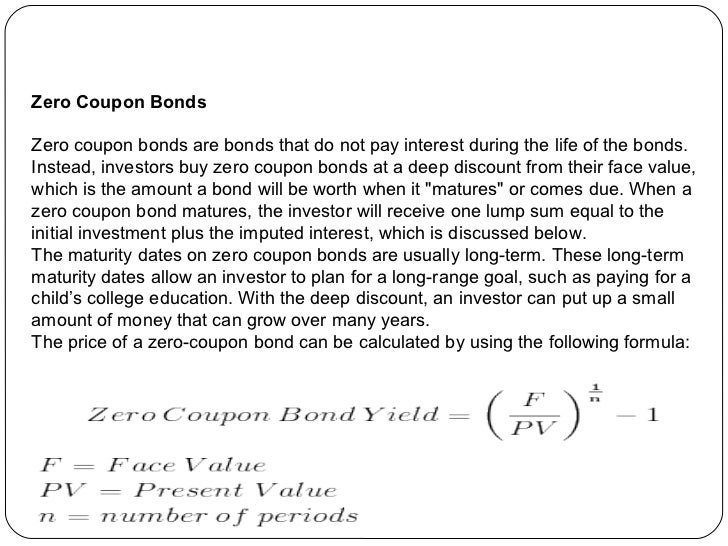

Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Jul 28, 2022 — A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. · Zeros-coupon ...

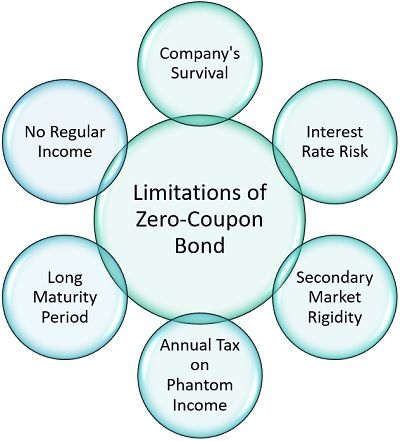

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

What are Bonds? | Definition & Types | Beginner's Guide Zero-Coupon Bonds Zero-coupon bonds (Z-bonds) type bonds do not make periodic coupon payments and instead are issued at a discount to their par value and repaid the total face value at maturity. For example, U.S. Treasury bills are zero-coupon bonds. Convertible Bonds

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero-Coupon Bonds - Accounting Hub Definition. A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia A zero-coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full-face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://blogger.googleusercontent.com/img/proxy/AVvXsEg3J9R2y9vfCdPchHc3HXHTbt9AQol-ebrfRYgguHXpB_Hu1-QgqQb-TdirvfC_9bRRWJyLpK2W55PF9qf5fR9rPJBDmn2O3NklvACn3Na3tt0tKlblkXaBIW8ZcvoU8HSOB8a1msSreBcvDjeaUoyfW6gI2liI-p9TMjgivCEW6PzWDFv7eXmdhiVOXX9jjg=s0-d)

Post a Comment for "44 zero coupon bonds definition"