41 present value of a zero coupon bond

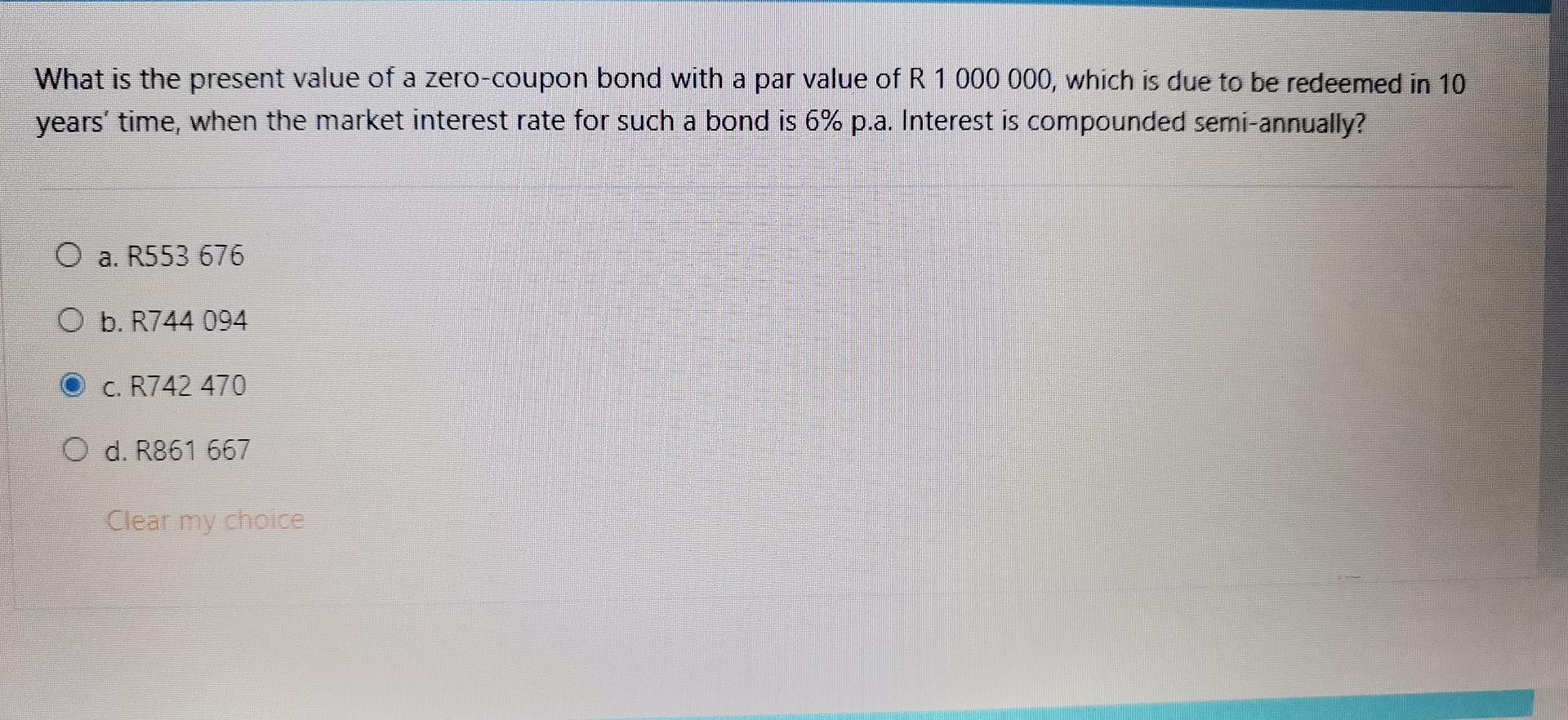

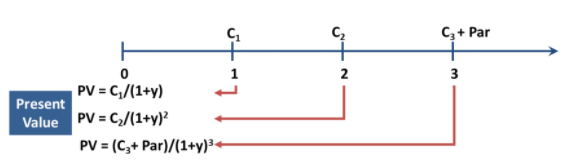

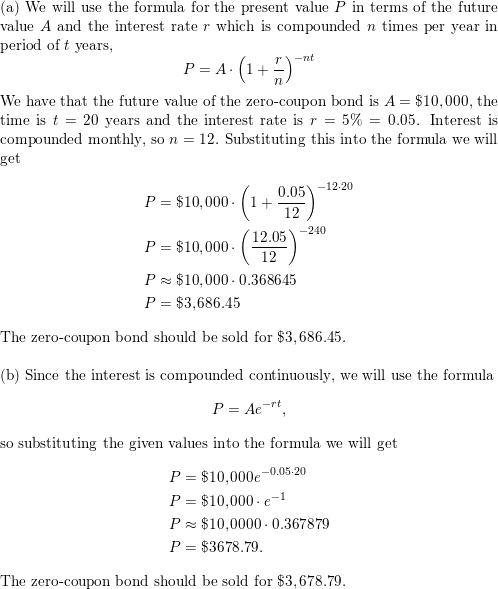

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Web16/07/2019 · The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. The investor pays 816 today and receives the face value of the bond (1,000) at the maturity date, as shown in the cash flow diagram below. Zero Coupon Bond Rates. The value of a zero coupon … Bond Present Value Calculator WebUse the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is greater than the …

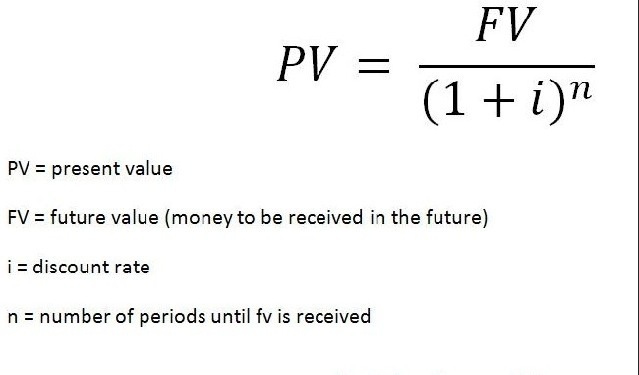

What Is Present Value in Finance, and How Is It Calculated? Web13/06/2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Present value of a zero coupon bond

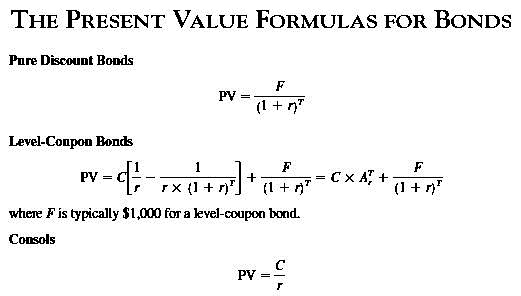

Bond Price Calculator – Present Value of Future Cashflows WebUsing the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Present value - Wikipedia WebIf a $100 note with a zero coupon, payable in one year, sells for $80 now, then $80 is the present value of the note that will be worth $100 a year from now. This is because money can be put in a bank account or any other (safe) investment that will return interest in the future. An investor who has some money has two options: to spend it right now or to save … Time value of money - Wikipedia WebHistory. The Talmud (~500 CE) recognizes the time value of money. In Tractate Makkos page 3a the Talmud discusses a case where witnesses falsely claimed that the term of a loan was 30 days when it was actually 10 years. The false witnesses must pay the difference of the value of the loan "in a situation where he would be required to give the money …

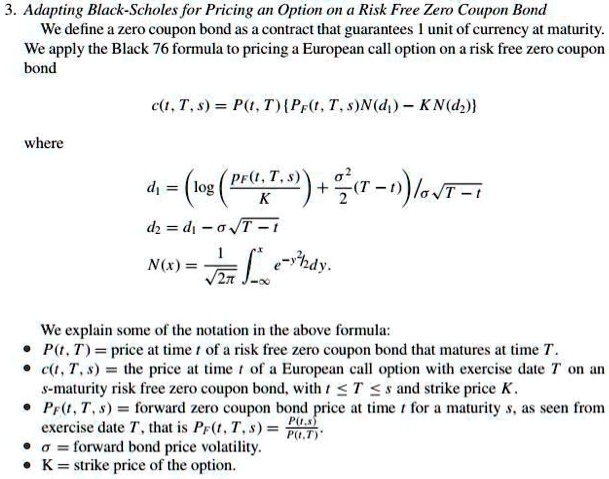

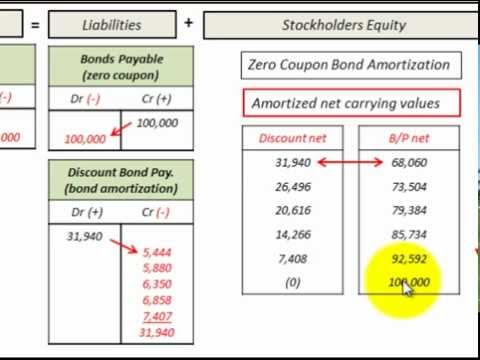

Present value of a zero coupon bond. Net present value - Wikipedia WebThe net present value (NPV) or net present worth (NPW) ... In the case when all future cash flows are positive, or incoming (such as the principal and coupon payment of a bond) the only outflow of cash is the purchase price, the NPV is simply the PV of future cash flows minus the purchase price (which is its own PV). NPV can be described as the "difference … Finance - Wikipedia Determining the present value of these future values, "discounting", must be at the risk-appropriate discount rate, in turn, a major focus of finance-theory. Since the debate as to whether finance is an art or a science is still open, [29] there have been recent efforts to organize a list of unsolved problems in finance . The Macaulay Duration of a Zero-Coupon Bond in Excel Web29/08/2022 · Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. more Macaulay Duration: Definition, Formula ... Zero Coupon Bond Value - Formula (with Calculator) - finance … WebAs shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change.

Zero Coupon Bond Calculator – What is the Market Value? WebZero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the ... Time value of money - Wikipedia WebHistory. The Talmud (~500 CE) recognizes the time value of money. In Tractate Makkos page 3a the Talmud discusses a case where witnesses falsely claimed that the term of a loan was 30 days when it was actually 10 years. The false witnesses must pay the difference of the value of the loan "in a situation where he would be required to give the money … Present value - Wikipedia WebIf a $100 note with a zero coupon, payable in one year, sells for $80 now, then $80 is the present value of the note that will be worth $100 a year from now. This is because money can be put in a bank account or any other (safe) investment that will return interest in the future. An investor who has some money has two options: to spend it right now or to save … Bond Price Calculator – Present Value of Future Cashflows WebUsing the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 present value of a zero coupon bond"